三个原因:三思而后考虑中国股票

布兰登里费09年8月12日上午9点50

我想跟进中国股票投资,我7月29日写下的一个来在过去数天内进行了一些花絮。这些投资者们应该好好三思中国市场投资。

1、 8月7日中国财政部副部长表示,政府会密切留意资产价格,创造一个“内部机制”,以稳定他们的股票市场。

解读:我们将您内定的驱动程序,以免让你回家,我们让你垮掉汽车(再次)。

STOCKSRELATED ARTICLESALSO按...搜索:

奇怪的是,同一天说,在同样的情况介绍,苏宁(一中国央行副行长),央行将不会考虑当资产价格调整政策。她接着说:“这不是将要进行微调的政策,但重点,力度和政策的步伐,将进行微调。”

因此,我们说的财政部长,中央银行正在研究-并非常担心-的细节,从股票市场的移动所产生的资金流,这也是暗示承认自己的需要执行的政策来解决它。与此同时,在同样的时间,央行官员说,他们不会考虑资产价格时的这样的政策。好事是他们在同时出现。

2、在8月6日接受彭博通讯社采访时,中国建设银行总裁张建国表示,该国第二大银行下半年将削减约70%新增贷款来避免坏帐激增。

“我们注意到一些贷款没有进入实体经济,”张先生说,在接受彭博新闻社19日接受在该银行的总部设在北京。 “我认为还有一些行业扩张过快。例如,住房价格上涨过快,住房销售增长过快。“

他们注意到,一些贷款没有进入实体经济?说得不仅如此!

谜语解读:如果中国从一个严重的金融风暴恢复增长可持续的方式检查,为何会在中国第二大银行会为不良贷款产生的新债务担心呢?

3、上周交易统计 8月6日个人投资者开立的帐户超过70万,是2008年1月以来最大。

这是一件好事负责贷款中方官员起初表示,他们并不担心到他们的证券市场要担心的是没有对普通人的影响,“投资者”的心理。我觉得这数目不言自明。

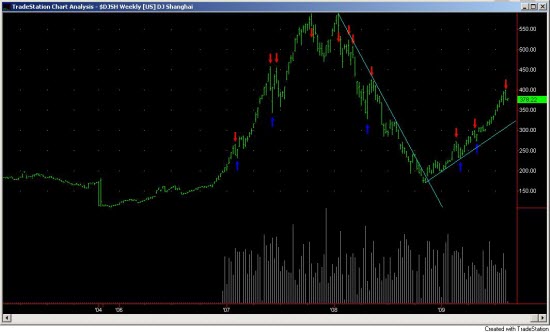

我还要指出,2008年1月份也有大量的双顶格局,并于上海,道琼斯指数的地方。道琼斯上海指数也经历了上周购买高潮。一个购买高潮时发生的股票,指数等作出更高的高度,较前一周,但低于前一周的紧密关闭。这通常发生在一个重要的,最运行在一个动荡和广泛周百分比方面强大。与此相反的是一个销售高潮的情况。见上海股票周线图上标记的实例。

目前还没有一个预测,只是一个观察。亚洲文化是真正迷人的几个层面。话虽如此,也应该考虑到有一个澳门蓬勃发展的个中原因。

原文:

Three Reasons to Think Twice About Chinese Equity

I wanted to follow up on the China piece I penned on July 29th with a few tidbits that have come out over the last few days. These should make investors think twice about the ramifications to the Chinese equity market.

1. On August 7th China’s Vice Finance Minister stated the government will monitor asset prices and create an “internal mechanism” to stabilize their stock market.

Translation: We will be your designated driver and get you home lest we let you crash the car (again).

Strangely, the very same day, at the very same briefing, Su Ning (a deputy governor of China’s central bank) said the central bank won’t consider asset prices when adjusting policies. She went on to say “It’s not the policies that will be fine tuned, but the focus, intensity, and pace of policies that will be fine tuned.”

So we have the finance minister saying the central bank is looking at -- and is concerned enough about -- the ramifications stemming from the stratospheric move in the equity market to admit their needing to implement policy to address it. Meanwhile, at the very same time a central bank official is saying they won’t consider asset prices when making such a policy. Good thing they're on the same page.

2. In an interview with Bloomberg news on August 6th, China Construction Bank Corp’s President Zhang Jianguo said that the nation’s second-largest bank will cut new lending by about 70 percent in the second half to avert a surge in bad debt.

“We noticed that some loans didn’t go into the real economy,” Mr. Zhang said in an interview with Bloomberg News on Thursday at the bank’s headquarters in Beijing. “I feel that some industries are expanding too rapidly. For example, housing prices are rising too fast, and housing sales are growing too fast.”

They noticed some loans didn’t go into the real economy? Say it isn’t so!

Riddle me this: If China was recovering in a sustainable manner from the grips of a serious gut-check in growth, why would the second largest bank in China be worried about bad debt resulting from new loans?

3. On August 6th individual investors opened more than 700,000 accounts to trade stocks last week, the most since January 2008.

It’s a good thing the loans Chinese officials initially said they weren't worried about going into their equity market isn’t having an effect on laymen “investor” psychology. I think the number speaks for itself.

I should also mention that January 2008 was also the month where the massive double top setup took place on the DJ Shanghai Index. The DJ Shanghai also experienced a buying climax last week. A buying climax occurs when a stock, index etc. makes a higher high than the previous week but closes below the previous week’s close. These usually occur after a significant run and are most powerful within the context of a volatile and wide percentage ranging week. The opposite is the case for a selling climax. See the weekly chart where I've denoted the instances.

Not a prediction, just an observation. Asian culture is truly fascinating on several levels. That being said, there is a reason Macau has prospered.